This is likely to be the case if the company is not large enough to fend off motivated buyers on its own. Strategic imperatives: A company may choose to divest its "crown jewels," a coveted division or asset base, in order to reduce its appeal to a buyer.A greater focus may translate into better financial results and improved profitability. Greater focus: Separation of a company into two or more businesses will enable each one to focus on its own game plan, without the company's executives having to spread themselves thin in trying to grapple with the unique challenges posed by distinct business units.One size does not fit all when it comes to capital requirements. This is especially useful when different business units within a company have varying capital needs. Efficient allocation of capital: Splitting up enables a more efficient allocation of capital to the component businesses within a company.The sum of the parts is usually greater than the whole in such cases. This will enable each distinct business to be valued more efficiently and typically at a premium valuation, compared with a hodgepodge of businesses that would generally be valued at a discount (known as the conglomerate discount), thereby unlocking shareholder value. Evolving into "pure play" businesses: Splitting up a company into two or more parts enables each to become a pure play (a publicly-traded company focused on only one industry or product) in a different sector.The parent company may spin off 100% of the shares in its subsidiary, or it may spin off 80% to its shareholders and hold a minority interest of less than 20% in the subsidiary.

The spin-off is a distinct entity from the parent company and has its own management. Existing shareholders benefit by now holding shares of two separate companies after the spin-off instead of one. The parent company typically receives no cash consideration for the spin-off.

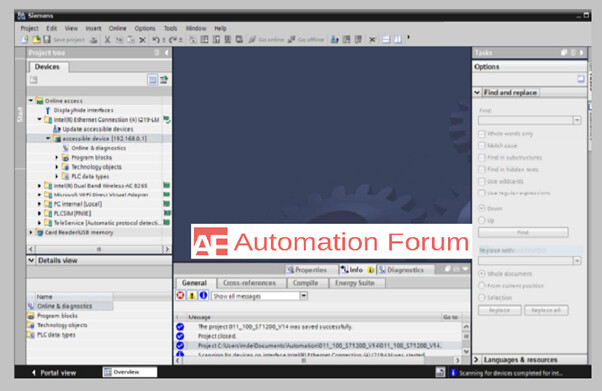

Difference entre step 5 et step 7 siemens pro#

In a spin-off, the parent company distributes shares of the subsidiary that is being spun-off to its existing shareholders on a pro rata basis, in the form of a special dividend. Most spin-offs tend to perform better than the overall market and, in some cases, better than their parent companies.A carve-out is when a parent company sells shares in the new subsidiary through an initial public offering (IPO).A split-off offers shares in the new subsidiary to shareholders but they have to choose between the subsidiary and the parent company.A spin-off distributes shares of the new subsidiary to existing shareholders.While there can be drawbacks to spin-offs, split-offs, and carve-outs, in most cases, where a separation is being considered, such synergies may have been minimal or non-existent.A spin-off, split-off, and carve-out are three different methods of divestment with the same objective: to increase shareholder value.

0 kommentar(er)

0 kommentar(er)